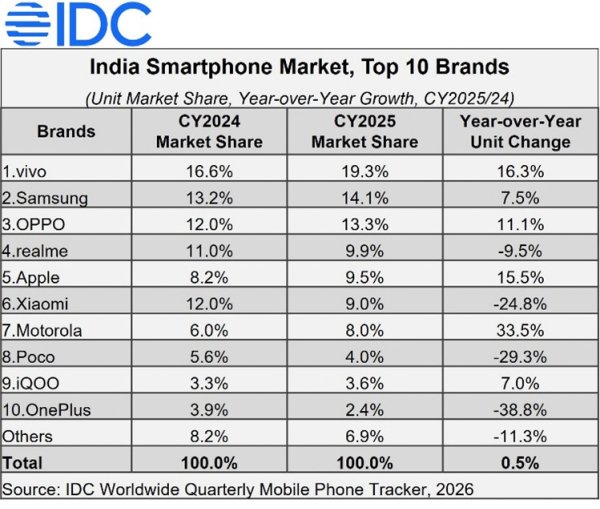

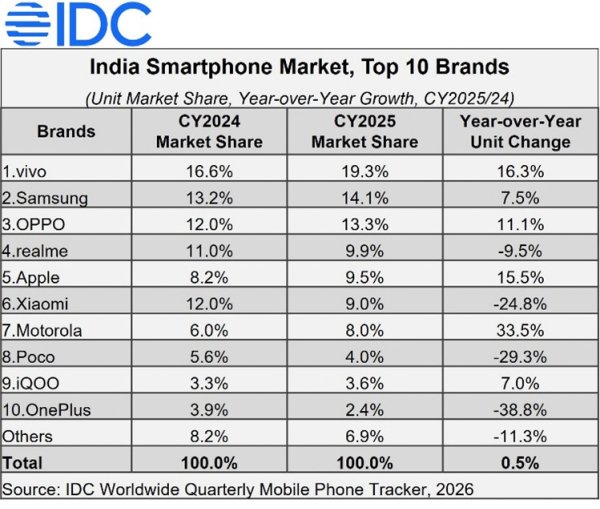

After a rocky start at the beginning of 2025, the Indian smartphone market recovered in mid-year and recorded a modest 0.5% year-over-year growth by the end, the latest IDC report claims. Manufacturers shipped 152 million units, and despite the market’s flat state, some smartphone makers capitalized, mainly due to shifting consumer preferences.

India’s consumers are increasingly more interested in high-value smartphones, demanding premium and feature-rich models. This is evidenced by the 9% year-over-year value growth and the increased average selling prices, which rose 4% YoY to $279.

Apple led in this segment, reaching a solid 29% market share by value. Interestingly, India is still the fourth-largest market for Apple after the USA, China and Japan. The company had an overall smartphone market share of 10%, taking the fifth spot.

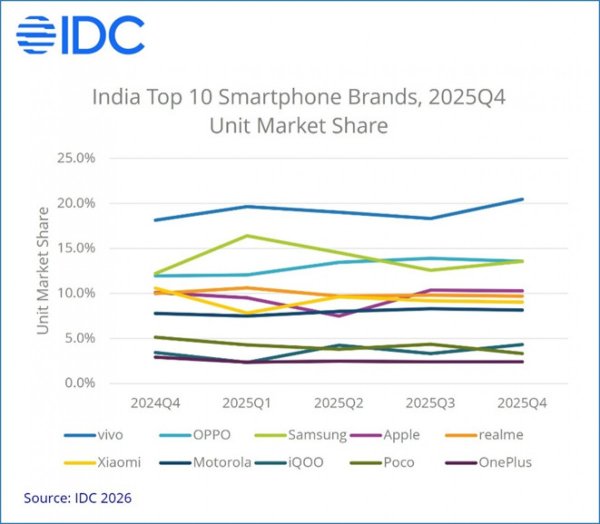

Vivo remains the market leader with a 19.3% market share, followed by Samsung with 14.1% and Oppo rounding up the top three with a 13.3% share. Realme recorded a 9.5% decline in shipments, but remained firmly in the fourth spot. OnePlus, Xiaomi and Poco are the worst performers of the bunch with 38.8%, 29.3% and 24.8% declines in sales throughout 2025.

Still, in the entry-level segment (sub-$100), Xiaomi and vivo are undisputed leaders, holding more than 40% of the market share.

The mass-budget leaders ($100-200) are vivo, Oppo and Motorola. The entry-premium ($200-400) market was led by vivo, Samsung and Motorola, while Samsung and Oppo dominated the mid-premium ($400-600) category. The proper premium ($600-800) market is dominated by Apple with a whopping 74% share, mainly due to its strong iPhone 15, 16 and 17 sales. These three phones accounted for over 65% of all shipments in the category.

The same goes for the super-premium ($800+) segment, where Apple reigns with 63% share, closely followed by Samsung, which recorded an 80% increase in sales, reaching 34% market share.

Notably, only the entry-level, mid-premium, premium and super-premium categories recorded a growth in 2025, with the premium category standing out with 37% year-on-year growth. The mid-premium’s performance is also notable, expanding by 23%.

Perhaps due to increasing wages across the country, Indian consumers are slowly adopting more premium devices. And while Xiaomi declined, other manufacturers capitalized. For instance, iQOO, Motorola and Nothing are the fastest-growing brands in 2025 in the country.

Source